Unlocking Opportunities: Leading Hard Money Lenders Atlanta genuine Estate Ventures

Wiki Article

Tough Money Lenders: Your Ultimate Guide to Rapid Money Car Loans

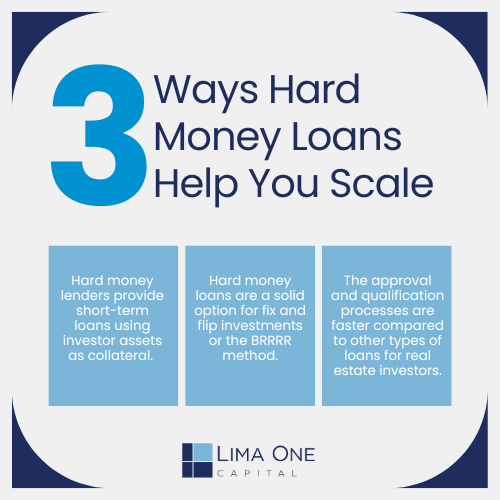

Browsing the realm of hard cash lending institutions can be a sensible option for those looking for quick accessibility to capital. These alternative financing resources use a way to secure funds quickly, often with much less rigorous requirements than traditional car loans. Nevertheless, the landscape of hard cash borrowing includes its own collection of intricacies and considerations. Recognizing the nuances of this monetary method can provide valuable understandings into leveraging rapid money finances efficiently.Comprehending Hard Money Lenders

Unlike typical lenders such as financial institutions or credit scores unions, hard cash lenders concentrate largely on the security (the residential or commercial property) rather than the debtor's credit report rating or financial background. This allows for a quicker authorization process, making hard cash fundings an attractive alternative for real estate financiers looking to safeguard financing promptly.Another trick difference is the flexibility supplied by tough money lenders. Standard lenders usually have strict requirements and prolonged approval processes, while hard money lending institutions are more interested in the home's worth and possible success. This versatility enables debtors to accessibility funding for tasks that may not fulfill standard lending requirements.

Furthermore, difficult cash lending institutions are generally private people or little teams, providing a much more efficient and individualized loaning experience contrasted to big financial institutions. In general, comprehending these vital distinctions is essential for any person taking into consideration using tough cash fundings for genuine estate investments.

Benefits of Fast Cash Fundings

An additional advantage of fast money financings is their adaptability. These car loans are often extra lax when it pertains to credit history ratings and financial histories, making them easily accessible to a wider series of customers. Furthermore, fast money lendings can be made use of for a selection of purposes, whether it's covering emergency situation expenditures, consolidating debt, or seizing a time-sensitive financial investment chance.

In addition, fast money finances can help debtors enhance their credit score ratings. By making prompt payments on a quick money car loan, customers can demonstrate their creditworthiness and potentially increase their credit score profile. This can open doors to more desirable lending terms in the future. Generally, the advantages of quick cash lendings make them a valuable device for people seeking fast economic aid.

Risks of Hard Cash Financing

Tough cash offering presents fundamental dangers that borrowers need to thoroughly think about before taking part in this economic setup. One significant threat is the high cost related to hard money fundings. Rates of interest for these finances can be significantly article greater than typical car loans, frequently ranging from 10% to 15% or even more. Furthermore, difficult cash lenders may charge additional charges, such as source charges, underwriting costs, and early settlement charges, which can even more raise the total expense of loaning.

An additional danger is the short repayment term usually connected with difficult money financings. Debtors typically have a much shorter period, commonly ranging from 6 months to a few years, to pay off the lending in complete. This can put considerable pressure on the consumer to either market check here the residential property rapidly or protect alternate financing to repay the hard money finance on time.

Additionally, difficult money lendings are protected by the building being purchased, making the debtor prone to potential foreclosure if they fall short to make timely settlements. It is important for borrowers to extensively analyze their capacity to pay back the loan within the brief duration to stay clear of the threat of losing their residential or commercial property.

Qualifying for Quick Financing

To safeguard fast funding via difficult money lending institutions, possible borrowers should show a strong security property or home for the car loan. The collateral serves as safety and security for the finance, offering a level of guarantee for the lending institution in situation the borrower defaults.In addition to a solid security possession, borrowers looking for fast funding from hard cash lending institutions must be prepared to give documents to support their financing application. This may include residential or commercial property evaluations, proof of revenue or properties, and a clear outline of just how the car loan funds will be utilized. Demonstrating a strong departure approach for repaying the lending is likewise vital for qualifying for quick article source financing through difficult money lending institutions.

Tips for Effective Loan Repayment

Effectively taking care of the repayment of a finance acquired from tough cash lenders calls for mindful preparation and financial self-control. To make certain successful financing repayment, beginning by producing a comprehensive spending plan that includes your monthly loan settlements. By adhering to these ideas, you can efficiently repay your tough money financing and maintain a positive financial standing.Final Thought

In verdict, hard money lending institutions supply a rapid and hassle-free choice for getting quick money financings. While there are benefits to this type of financing, it is crucial to be knowledgeable about the threats involved. By comprehending the credentials for these financings and carrying out methods for effective settlement, debtors can make the most of difficult money offering opportunities.

Conventional finances usually entail lengthy approval procedures, but with rapid money fundings, customers can usually get the funds they need within an issue of days, or even hours in some instances. (hard money lenders atlanta)

Passion rates for these car loans can be substantially higher than typical lendings, commonly varying from 10% to 15% or more.To safeguard fast funding through tough cash lending institutions, possible borrowers need to show a strong collateral property or home for the finance.In addition to a solid collateral possession, consumers looking for fast financing from tough cash loan providers ought to be prepared to offer documentation to support their lending application. To make sure effective loan repayment, begin by developing an in-depth spending plan that includes your monthly financing repayments.

Report this wiki page